What is the Permanent Portfolio?

The Permanent Portfolio is a passive investment strategy that divides assets into four equal parts: 25% in stocks, 25% in long-term bonds, 25% in gold, and 25% in cash.

This distribution is not arbitrary. Harry Browne designed it after years of economic analysis, concluding that these four assets, combined in equal proportions, offer protection in any phase of the economic cycle.

The philosophy behind the Permanent Portfolio is radically different from traditional investing:

- It doesn't try to predict the future: It assumes nobody knows what will happen in the economy

- It doesn't require market timing: You buy and hold, without trying to "buy low and sell high"

- It prioritizes capital preservation: The main goal is not to lose; the secondary goal is to gain

- It requires minimal maintenance: You only need to rebalance once a year at most

Why exactly 25% in each asset and not another combination like 30/30/20/20? Browne experimented with multiple combinations and discovered that equal distribution offered the best balance between protection and long-term returns.

Who was Harry Browne?

Harry Browne (1933-2006) was an American writer, politician, and financial analyst. Although he ran twice for president as a Libertarian Party candidate, his most lasting legacy is in the world of personal finance.

Browne began his career as an investment analyst in the 1960s, an era of great economic uncertainty with the Vietnam War, the end of the gold standard, and the oil crisis on the horizon. This experience taught him a fundamental lesson: experts rarely get their predictions right.

In 1970, he published "How You Can Profit from the Coming Devaluation," where he was already outlining ideas about wealth protection. But it was in his 1999 book "Fail-Safe Investing" where he presented the definitive version of the Permanent Portfolio.

His philosophy is summarized in a famous quote:

"The Permanent Portfolio is designed to protect money you cannot afford to lose."

The 4 Economic Scenarios

The genius of the Permanent Portfolio lies in its design for the four possible states of the economy. At any given time, the economy is in one of these scenarios (or transitioning between them):

Prosperity

In times of economic growth and optimism, stocks shine. Companies increase their profits, consumers spend more, and stock markets rise.

During these periods, the 25% of your portfolio in stocks captures bull market gains. Other assets may have modest returns, but stocks more than compensate.

Historical example: The boom of the 1990s with the tech surge.

Inflation

When prices rise across the board and money loses purchasing power, gold acts as a refuge. Historically, gold has maintained its value against inflation for millennia.

The 25% in gold protects your wealth when cash and bonds lose real value. During periods of high inflation, gold can multiply in value.

Historical example: The inflation of the 1970s-80s when gold went from $35 to $850 per ounce.

Deflation

Deflation (generalized price drops) usually comes with economic crises and falling interest rates. In this scenario, long-term bonds are the protagonists.

When rates fall, existing bonds with higher rates appreciate enormously. The 25% in long-term bonds can generate exceptional returns during deflation.

Historical example: The 2008 crisis where Treasury bonds soared while everything else fell.

Recession

In recessions, with market drops, uncertainty, and potential bankruptcies, cash is king. Having liquidity allows you not only to survive but to seize opportunities.

The 25% in cash provides stability and the ability to rebalance by buying cheap assets when others are panic selling.

Historical example: The 2020 COVID crash where those with cash could buy at lows.

Historical Returns of the Permanent Portfolio

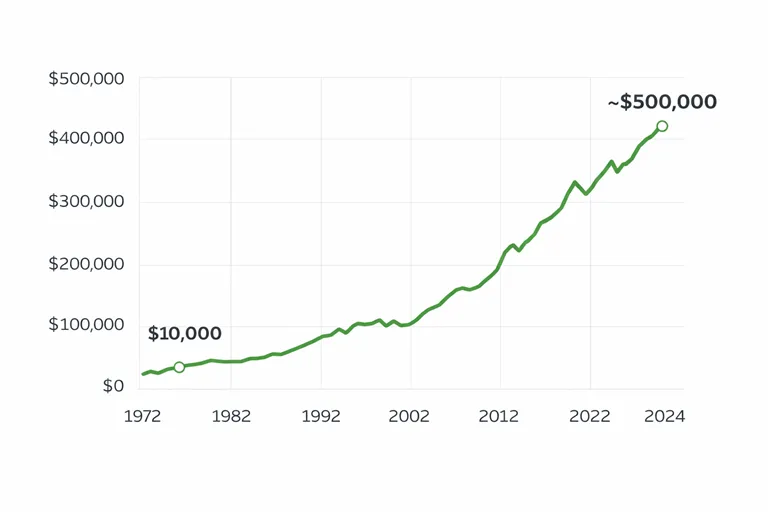

One of the most frequent questions is: does it really work? The historical data is compelling.

From 1972 to 2024, the Permanent Portfolio has generated:

| Metric | Value |

|---|---|

| Average annual return | 6.8% |

| Best year | +17.4% (1979) |

| Worst year | -4.1% (2022) |

| Positive years | 47 of 52 (90%) |

| Maximum drawdown | -12.7% |

| Annual volatility | 7.5% |

Comparison with other strategies

| Strategy | Return | Volatility | Worst year |

|---|---|---|---|

| Permanent Portfolio | 6.8% | 7.5% | -4.1% |

| 100% Stocks (S&P 500) | 10.5% | 17% | -37% |

| Traditional 60/40 | 8.2% | 10% | -22% |

| Savings account | 3% | 0% | 0% |

Why would anyone choose 6.8% over 10.5%? The answer lies in volatility and drawdowns. A 100% stock investor would have suffered 37% drops (2008) or 50% (2000-2002). The Permanent Portfolio has never lost more than 13% at its worst.

The Power of Consistency

The magic of the Permanent Portfolio isn't in spectacular years, but in the absence of disastrous years. It has only had 5 negative years in 52 years, and the worst was a 4.1% drop.

This consistency allows:

- Sleeping well during crises

- Maintaining the strategy without panic

- Benefiting from compound interest without interruptions

Advantages of the Permanent Portfolio

1. Extreme Simplicity

You only need 4 financial products. No need to analyze companies, sectors, or trends. Anyone can implement it in an afternoon.

2. Low Volatility

With annual volatility of 7.5% (versus 17% for the stock market), fluctuations are much more psychologically bearable.

3. Protection in Any Scenario

It doesn't matter if inflation, deflation, prosperity, or recession comes: there's always an asset working in your favor.

4. Minimal Maintenance

Check once a year and rebalance if necessary. No more than 30 minutes of annual management.

5. Proven for 50+ Years

It's not a trendy strategy or an experiment. It's been working for half a century through crises, wars, pandemics, and all kinds of scenarios.

6. Very Low Costs

With modern ETFs, you can implement the Permanent Portfolio with costs under 0.15% annually.

Disadvantages of the Permanent Portfolio

No strategy is perfect. It's important to know the limitations:

1. Lower Returns in Bull Markets

When stocks rise 20%, your portfolio only captures part of that rise. The remaining 75% in other assets "drags" total performance.

2. Gold Doesn't Generate Dividends

Unlike stocks or bonds, gold produces no income. Its value comes only from price appreciation.

3. Requires Discipline

When an asset rises a lot (like stocks in 2021), the temptation to abandon the strategy is strong. Maintaining 25% requires conviction.

4. Not for Maximizing Wealth

If your goal is to get rich quick, the Permanent Portfolio isn't your strategy. It's for preserving and growing modestly.

5. Cash Component Yields Little

With low rates, the 25% in cash can feel like an "anchor." However, that cash is crucial during crises.

Who is the Permanent Portfolio For?

The Permanent Portfolio is especially suitable for:

Conservative Investors

If you prioritize not losing money over maximizing gains, this strategy is designed for you.

People Near Retirement

When you don't have decades to recover from a 50% drop, low volatility is crucial.

FIRE Movement with Moderate Profile

Those seeking financial independence but preferring a safer path than 100% stocks.

Those Seeking Simplicity

If you don't want to spend time studying markets, the Permanent Portfolio is managed in minutes per year.

Wealth You Can't Afford to Lose

Money for your children's education, extended emergency fund, or inheritance you want to preserve.

Who is the Permanent Portfolio NOT For?

The Permanent Portfolio is NOT suitable for:

Young, Aggressive Investors

If you're 25 with decades ahead, you can take more risk for potentially higher returns.

Those Looking to Maximize Returns

If your goal is to beat the market, you need another strategy (assuming more risk).

Day Traders or Speculators

The Permanent Portfolio is the opposite of active trading. It's boring by design.

Those Who Can't Tolerate Seeing Gold or Bonds "Doing Nothing"

In certain periods, some assets will be flat. You have to accept it.

How to Implement the Permanent Portfolio

Implementing the Permanent Portfolio is surprisingly simple:

Step 1: Choose Your Method

Option A - All-in-one fund: Some funds replicate the Permanent Portfolio automatically.

Option B - Do it yourself (DIY): You buy the 4 assets separately with ETFs. Cheaper but requires slightly more work.

Step 2: Select the Products

To implement your Permanent Portfolio, you need to choose an ETF or fund for each of the 4 assets. Selecting the right products is crucial to minimize costs and maximize tax efficiency.

Which products to choose? Our app includes a complete guide with the best ETFs for each asset, in both euros and dollars, with cost comparisons and personalized recommendations based on your country of residence.

Step 3: Divide Your Capital

Simply divide your total investment by 4. If you have $10,000:

- $2,500 in stocks

- $2,500 in bonds

- $2,500 in gold

- $2,500 in cash

Step 4: Rebalance Annually

Once a year, check if any asset has deviated much from 25%. If so, sell from what has risen and buy what has fallen.

Harry Browne's Rule: Only rebalance if an asset exceeds 35% or falls below 15%.

Frequently Asked Questions

How much money do I need to start?

Technically you can start with any amount, but to diversify well across 4 ETFs, we recommend at least $1,000. With index funds, you can start with less.

How often should I rebalance?

Harry Browne recommended checking once a year and only rebalancing if an asset exceeds 35% or falls below 15%. Don't rebalance more than necessary to avoid costs and tax complications.

Does the Permanent Portfolio work in Europe/USA?

Absolutely. In fact, there are specific products in both USD and EUR that make implementation easy.

Can I combine the Permanent Portfolio with other strategies?

Yes, many investors use the Permanent Portfolio for their "base wealth" and allocate a smaller percentage to more aggressive strategies.

What broker is best for the Permanent Portfolio?

This depends on your country. In the US, brokers like Fidelity, Vanguard, or Interactive Brokers work well. In Europe, Interactive Brokers, Trade Republic, or local options are excellent.

Is investing in gold safe?

Physical gold (through ETCs) is backed by real bars stored in vaults. It's one of the safest investments that has existed for thousands of years.

Conclusion

Harry Browne's Permanent Portfolio is one of the most elegant, simple, and proven investment strategies in existence. It doesn't promise to make you rich quickly, but it offers something more valuable: financial peace of mind and protection against the unpredictable.

With just 4 assets in equal proportions, this strategy has navigated crises, wars, pandemics, inflation, and deflation for over 50 years with consistent results.

If you're looking for a way to invest that:

- Doesn't require predicting the future

- Lets you sleep soundly

- Works in any economic scenario

- Requires minimal maintenance

The Permanent Portfolio may be exactly what you need.

Ready to start? Our app helps you implement and manage your Permanent Portfolio easily. You can also use our backtesting tool to simulate the historical performance of your portfolio.

![How to Implement the Permanent Portfolio Step by Step [2025]](/images/blog/cartera-permanente-implentar-06.webp)