How to Implement the Permanent Portfolio: Practical Step-by-Step Guide

You've decided that the Permanent Portfolio is the investment strategy you've been looking for. You understand its philosophy: 25% stocks, 25% bonds, 25% gold, and 25% cash to prosper in any economic scenario. But now you face the real challenge: how do I implement it in practice?

In this guide, I'll explain the complete step-by-step process to implement your Permanent Portfolio from scratch. You'll learn what types of products you need, how to choose the right broker, and the exact process to make your first investments.

Important note: This guide focuses on teaching you the process and types of products you need. Specific ISINs, concrete product names, and detailed updated comparisons are available in our app, along with a calculator that tells you exactly how much to invest in each.

Let's turn theory into practice.

Before Starting: What You Need to Know

Before opening any account or making any purchase, make sure you meet these basic requirements:

Recommended minimum capital: Although you can technically start with any amount, I recommend having at least $1,000 (or €1,000) to begin. With less, transaction costs can represent too high a percentage of your investment. If you only have $500, you can start, but consider adding capital each month until you achieve a balanced distribution.

Time horizon: The Permanent Portfolio is designed for the long term: minimum 5-10 years. If you need your money sooner, this isn't the right strategy for you. The power of the Permanent Portfolio manifests over decades, not months.

Risk profile: Although the Permanent Portfolio is more conservative than a 100% stocks portfolio, you'll still see fluctuations in your wealth. You need to be mentally prepared to see 10-15% drops during difficult periods (although historically they recover quickly).

Required documentation: To open a broker account, you'll need your ID/passport, a bank account number (IBAN), and in some cases proof of tax residence. Have these documents ready before starting the process.

With these fundamentals clear, let's move on to implementation.

Step 1: Choose Your Implementation Method

There are two main ways to implement the Permanent Portfolio, each with advantages and disadvantages:

Option A: Delegated Fund (All-in-One)

A delegated fund is a financial product that implements the Permanent Portfolio strategy for you. You buy a single fund that internally invests in the four assets and rebalances automatically.

Advantages:

- Zero management on your part

- Automatic rebalancing included

- Single product to manage

- Ideal if you value your time over cost

Disadvantages:

- More expensive: typically 0.5-0.8% annual total costs

- Less control over specific implementation

- Limited availability depending on your country

- May have entry/exit fees

Who is it ideal for? Investors who prioritize absolute simplicity and are willing to pay a bit more for it. People with little time or who don't want to get involved at all in management.

Option B: Do It Yourself (DIY)

In this method, you buy the four assets separately (stocks, bonds, gold, cash) and manage rebalancing manually once a year.

Advantages:

- Much cheaper: typically 0.1-0.2% annual total costs

- Total control over which specific products you buy

- Flexibility to adjust according to your circumstances

- Greater knowledge of your own portfolio

Disadvantages:

- Requires some initial work (2-3 hours)

- You need to manage annual rebalancing (30 minutes per year)

- Four different products to track

Who is it ideal for? Most investors. If you're reading this guide, you're probably interested in understanding your investment, and the DIY method gives you the best balance between cost and control.

My recommendation: Go for the DIY method unless you truly value your time at more than $100/hour. The cost difference (0.4-0.7% annual) on a $50,000 portfolio is $200-350 per year. Over 30 years, we're talking about tens of thousands of dollars in difference for a few hours of work.

Step 2: Choose Your Broker

The broker is the platform where you'll open your investment account and buy the products. Your choice will affect which specific products you can buy, transaction costs, and user experience.

For Investors in Spain

| Broker | Best for | IBAN | Form 720 | Transaction costs |

|---|---|---|---|---|

| MyInvestor | Index funds (tax advantage on transfers) | 🇪🇸 Spanish | ❌ No | €0 (funds) |

| Trade Republic | ETFs + Interest-bearing account at 2%+ | 🇪🇸 Spanish | ❌ No | €1 per order |

| Interactive Brokers | Advanced investor, global access | 🌍 Foreign | ⚠️ Yes (>€50k) | Variable (~€3-10) |

For US Investors

| Broker | Best for | Transaction costs | Account minimum |

|---|---|---|---|

| Fidelity | Zero-fee ETFs, excellent research | $0 ETF trades | $0 |

| Vanguard | Low-cost index funds, buy-and-hold | $0 ETF trades | $0 |

| Interactive Brokers | Advanced features, global access | $0 ETF trades (conditions apply) | $0 |

Selection criteria:

- Product availability: Verify that the broker offers access to the products you need (stock and bond ETFs, gold ETCs, money market funds or interest-bearing account).

- Transaction costs: With the DIY method, you'll make approximately 4 purchases at the start + 4-8 transactions per year for rebalancing. Calculate the total annual cost.

- Regulation: All mentioned brokers are regulated (SEC in US, CySEC/BaFin in Europe), so your investments are protected.

- Interface and experience: Trade Republic stands out for its intuitive mobile app. Fidelity and Vanguard are simple for beginners. Interactive Brokers is more complex but very powerful.

Once you've chosen your broker, the next step is understanding what types of products you need to buy.

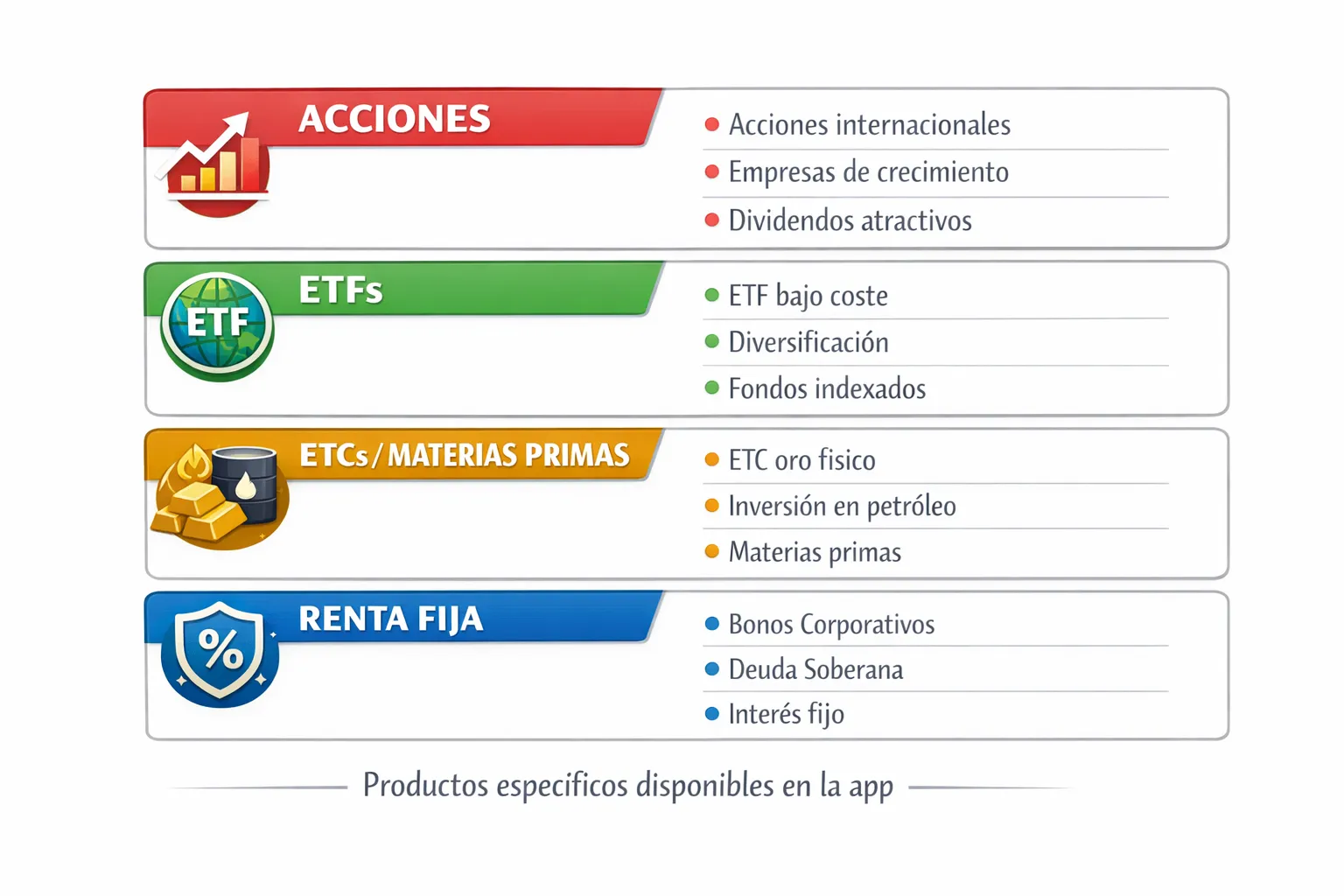

Step 3: What Types of Products You Need

This is where many beginner investors get stuck. I'll explain what type of product you need for each asset, but without specific ISINs (those are in the app, because they depend on your broker and are updated regularly).

Euro Portfolio (for European investors)

| Asset | Product type | Key characteristics | Typical TER |

|---|---|---|---|

| 25% Stocks | Eurozone equity ETF | • Physical replication (not synthetic)<br>• Accumulating (not distributing)<br>• Broad diversification (>100 companies)<br>• Low cost | 0.05-0.20% |

| 25% Bonds | Long-term government bonds ETF (20+ years) | • Duration >20 years<br>• AAA issuers (Germany, France...)<br>• Denominated in euros<br>• Accumulating preferable | 0.05-0.15% |

| 25% Gold | Physically-backed gold ETC 1:1 | • Real physical gold in vaults<br>• ETC, not ETF (important)<br>• No leverage<br>• Physical replication | 0.12-0.25% |

| 25% Cash | Interest-bearing account or money market fund | • Immediate liquidity<br>• No exit fees<br>• Yield >2-3% preferable<br>• No duration risk | 0-0.15% |

Total estimated cost: 0.07-0.19% annually

Important note about gold: Look for an ETC (Exchange-Traded Commodity), NOT an ETF. Gold ETFs are usually synthetic or invest in mining stocks, not physical gold. Physical gold ETCs are backed 1:1 by real gold stored in audited vaults.

Dollar Portfolio (for US investors or USD preference)

| Asset | Product type | Key characteristics | Typical TER |

|---|---|---|---|

| 25% Stocks | S&P 500 or US total market index ETF | • Ultra-low TER <0.10%<br>• High liquidity<br>• Accumulating or distributing<br>• Billions in AUM | 0.03-0.10% |

| 25% Bonds | Long-term US Treasury ETF (20+ years) | • Duration >20 years<br>• US Treasury Bonds<br>• Minimum credit risk<br>• High liquidity | 0.03-0.15% |

| 25% Gold | Physically-backed gold ETC | • Physical gold in vaults<br>• Denominated in USD<br>• No leverage<br>• Regular audits | 0.12-0.40% |

| 25% Cash | 0-1 year Treasury Bills ETF or interest-bearing account | • Maturity <1 year<br>• No interest rate risk<br>• High liquidity<br>• Current yield ~4-5% | 0.05-0.15% |

Total estimated cost: 0.06-0.20% annually

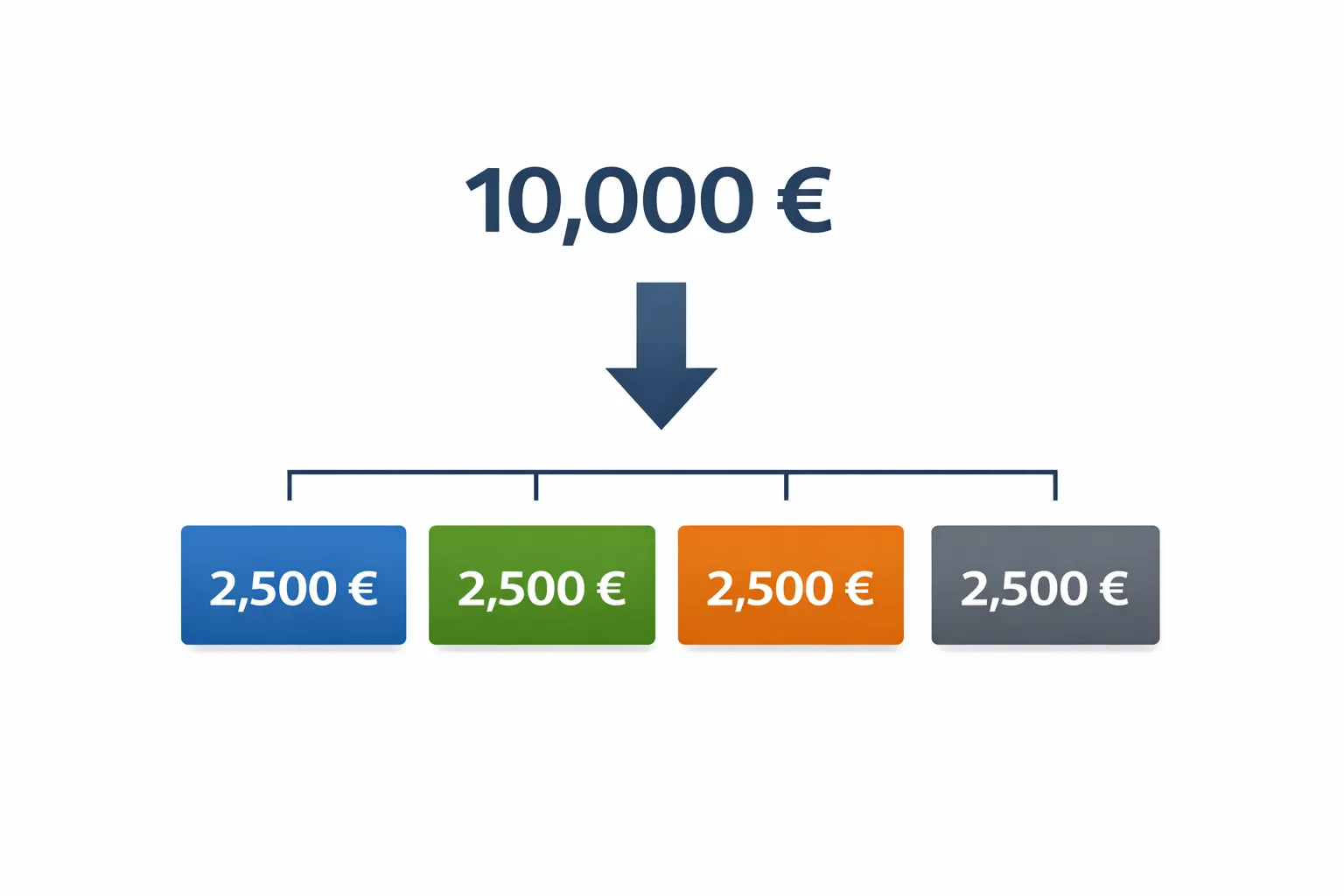

Step 4: Calculate How Much to Invest in Each Asset

This is the simplest part. The Permanent Portfolio uses a static 25% distribution in each asset, regardless of market conditions.

Basic formula:

```

Total available capital ÷ 4 = Amount per asset

```

Example with $10,000:

- $10,000 ÷ 4 = $2,500 per asset

- $2,500 in stocks

- $2,500 in bonds

- $2,500 in gold

- $2,500 in cash

Example with €25,000:

- €25,000 ÷ 4 = €6,250 per asset

Practical tip: Don't obsess over perfect accuracy to the cent. If you end up with $2,450 in stocks and $2,550 in bonds, it doesn't matter at all. The key to the Permanent Portfolio isn't perfect mathematical precision, but the discipline to maintain the distribution over time.

Step 5: Make the Purchases

The time has come to execute. The process varies slightly depending on whether you use a fund broker or ETF broker:

On fund brokers (example: MyInvestor, Vanguard)

- Access your verified account (you'll have already passed the KYC identity verification process)

- Search for each fund by name or ISIN in the platform's search

- Verify the details: Confirm it's the correct product (name, ISIN, TER)

- Set the amount: Enter the amount in currency (e.g., $2,500)

- Confirm the purchase: Review all data and confirm

- Repeat for each asset: Complete all 4 assets

Fund advantage: Purchases are in currency, not number of shares. You write "$2,500" and the system automatically calculates how many shares that is.

On ETF brokers (example: Trade Republic, Interactive Brokers, Fidelity)

- Access your account and fund it with initial capital

- Search for each ETF/ETC by ISIN (more precise than by name)

- Verify the details: Confirm ISIN, TER, replication type

- Calculate shares: Divide your target capital by current price

- Example: $2,500 target ÷ $68.40 price = 36.5 → Buy 36 shares

- Order type: For your first purchase, use a market order (executes immediately at best available price)

- Confirm: Review commissions and confirm purchase

- Repeat for each asset

Important tip: Make all purchases on the same day if possible, or in the same week. This ensures your initial distribution reflects market conditions at the same time.

Step 6: Set Up Alerts and Tracking

Your Permanent Portfolio is implemented. Congratulations. Now comes the hardest part: doing nothing for a year.

Recommended Review Frequency

Once a year, at the end of December or beginning of January. That's it. You don't need to check your portfolio every week, month, or quarter. In fact, doing so can be counterproductive, generating unnecessary anxiety.

Exception: If any asset deviates extremely (>50% or <10%), you can review earlier. This is rare and usually only occurs in severe crises.

When to Rebalance: The 35/15 Rule

In your annual review, calculate the current weight of each asset:

```

Current weight = (Current asset value ÷ Total portfolio value) × 100

```

Rebalance if:

- Any asset exceeds 35% (should be 25%), or

- Any asset falls below 15% (should be 25%)

Example:

- Stocks: 32% ✓ (within 15-35% range)

- Bonds: 20% ✓

- Gold: 18% ✓

- Cash: 30% ✓

→ No rebalancing needed

Example that DOES require rebalancing:

- Stocks: 38% ⚠️ (exceeds 35%)

- Bonds: 23%

- Gold: 14% ⚠️ (below 15%)

- Cash: 25%

→ Sell stocks, buy gold

Common Implementation Mistakes (and How to Avoid Them)

I've seen many investors make these mistakes. Learn from them:

1. Buying products with high costs (TER >0.5%)

Mistake: Buying the first stock ETF you find, without checking the TER (Total Expense Ratio).

Consequence: An ETF with TER of 0.60% vs one of 0.12% costs you 0.48% extra each year. In a $50,000 portfolio over 30 years, this represents tens of thousands of dollars.

Solution: Always verify TER before buying. Look for products with:

- Stock/bond ETFs: TER <0.20%

- Gold ETCs: TER <0.30%

2. Confusing ETF with ETC for gold

Mistake: Buying a "gold ETF" that actually invests in mining company stocks or uses synthetic derivatives.

Consequence: You don't have exposure to physical gold, but to mining stocks (which don't faithfully replicate gold price).

Solution: For gold, look for ETC (Exchange-Traded Commodity) with physical backing. Verify in the details that it says "physically backed" or "1:1 physical backing".

3. Rebalancing too frequently

Mistake: Checking the portfolio every month and rebalancing every time there's a small deviation.

Consequence:

- Accumulated transaction costs

- Taxes on unnecessary capital gains

- More administrative work

- Constant anxiety

Solution: Rebalance only once a year using the 35/15 rule. Resist the temptation to constantly "optimize".

4. Forgetting currency conversion costs

Mistake: Buying USD-denominated ETFs using a European broker without considering EUR→USD conversion cost.

Consequence: Some brokers charge 0.5-1% for currency conversion, which can eliminate the low-cost advantages of the ETF.

Solution: If you invest in euros, look for EUR versions of products. If buying in USD is inevitable, verify your broker's conversion fees.

5. Not considering taxation (funds vs ETFs in Spain)

Mistake: In Spain, choosing ETFs without knowing that investment funds allow tax-free transfers (deferring taxes).

Consequence: If you use ETFs and want to change products, you pay taxes immediately on capital gains (19-26%). With funds, you can transfer indefinitely deferring taxes.

Solution:

- If you invest in Spain and your broker offers adequate index funds (like MyInvestor), consider using them for stocks and bonds

- For gold and cash, there's no fund alternative, so use ETCs and interest-bearing accounts

Frequently Asked Questions

Can I start with $500?

Yes, but it's not ideal. With $500 ($125 per asset), transaction costs represent a high percentage. My recommendation:

Option 1: Save until you have $1,000-2,000 and then implement the complete portfolio.

Option 2: Start with $500 in a money market fund (cash) with no fees, and add $100-200 monthly until completing all four assets in 4-6 months.

Do I need all 4 assets from the beginning?

Ideally yes, because the power of the Permanent Portfolio comes from the decorrelation among the four assets. However, if your initial capital is very limited (<$1,000), you can implement it gradually:

Month 1: 25% cash + 75% in a temporary balanced fund

Month 2-4: Buy each asset with new contributions

Month 5: You already have all four complete assets

What if a product isn't available at my broker?

There will almost certainly be alternatives. For example:

- If the European bond ETF you're looking for isn't available, there will be 3-5 others with similar characteristics

- If your broker doesn't have physical gold ETCs, consider changing brokers or using an alternative gold fund

Selection criterion: Always prioritize characteristics (physical replication, low TER, high liquidity) over specific brands.

How do taxes affect me?

In the US:

- ETF capital gains: Tax on sale, 0-20% depending on income and holding period (long-term >1 year: 0%, 15%, or 20%)

- Dividends: Qualified dividends taxed at capital gains rates

- Tax-advantaged accounts: Consider using IRA or 401(k) for tax deferral

In Spain:

- ETF capital gains: Tax on sale, 19% (up to €6,000), 21% (€6,000-50,000), 23% (€50,000-200,000), 26% (>€200,000)

- Fund transfers: Defer taxes by moving between funds without taxation

- Dividends: If your ETFs are accumulating (reinvest dividends), you don't pay taxes until selling

Tax strategy:

- In US: Use tax-advantaged accounts when possible

- In Spain: Use index funds for stocks/bonds if your broker allows (transfer advantage)

- Hold long-term to minimize tax events

- Rebalance by contributing new capital when possible, avoiding sales

Where do I find the exact ISINs of recommended products?

Specific ISINs, updated comparisons, and products recommended by broker are in our app. Why?

- Updated monthly (costs, availability, new products)

- Specific by broker (not all have access to the same ones)

- Include calculator that tells you exactly how much to buy

- Product verification to prevent buying the wrong product

Conclusion: From Theory to Action

You now know the 6 steps to implement your Permanent Portfolio:

- ✅ Choose your method (DIY recommended)

- ✅ Choose your broker (MyInvestor, Trade Republic, Fidelity, Vanguard, or Interactive Brokers depending on your profile)

- ✅ Understand what types of products you need (ETFs, ETCs, funds)

- ✅ Calculate distribution (25% in each asset, simple formula)

- ✅ Make purchases (specific process by broker type)

- ✅ Set up annual tracking (35/15 rule for rebalancing)

You've learned HOW to implement the Permanent Portfolio. You understand the process, product types, and exact steps.

But you're still missing the final piece: knowing EXACTLY WHAT TO BUY.

Specific ISINs, concrete product names, updated cost comparisons, and personalized recommendations based on your broker... all that can't be in a static article that becomes outdated.

Ready to start? Our app helps you implement and manage your Permanent Portfolio easily. You can also use our backtesting tool to simulate the historical performance of your portfolio, or read our complete guide on what the Permanent Portfolio is.